Public Library Funding In Wisconsin

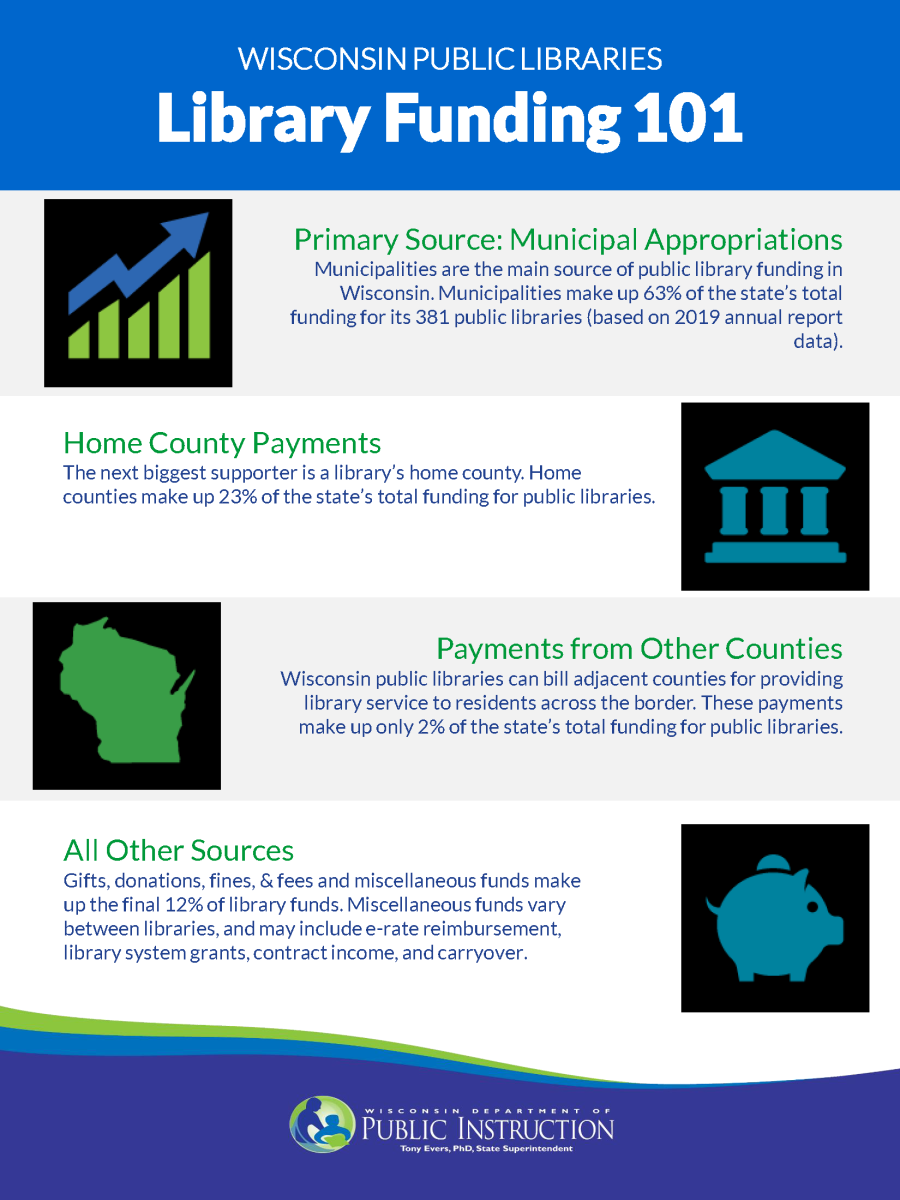

Most, but not all, of the public libraries in Wisconsin are funded primarily by their governing body. In other words, most of a city or village library’s funding comes from the city or village; joint libraries usually split costs, as determined in their joint library agreement contract; county or tribal libraries are mostly funded by the county or tribe. As of 2012, when Maintenance of Effort was repealed in the state biennial budget, no statutory minimum support by the governing body currently exists in statute. The amount appropriated to the library is determined during the municipal, county, or tribal budget process.

Libraries that do not have a county as their governing body are entitled to payments for use of their library by residents of their home county who live in municipalities that do not have a library. These users are commonly referred to as “rural residents,” and the usage is referred to as “rural circulation.” By statute, a library is reimbursed at a rate no lower than 70 percent of the cost of this rural circulation.

These libraries are also entitled to payments from counties adjacent to their home county (they must share a border at any point), at a minimum of 70 percent, for usage by residents of those counties. A library seeking adjacent county payments must bill the adjacent county in order to receive these payments. The amount is calculated using the same general formula as the one used for the home county. Consolidated county libraries have the option to choose whether or not to bill adjacent counties; however, if a consolidated county library bills an adjacent county, then their county is subject to billing by libraries in adjacent counties. Think of this as a doorway: if a consolidated county library opens the door and bills other counties, the door is then left open for others to bill their county.

Last, our state structure is set up so that state funding goes to public library systems, rather than to individual libraries, for coordinated library services. The only exceptions are some state and federal grants that may be offered for specific initiatives. State aid is funded in part by federal LSTA funds, as distributed by the Institute for Museum and Library Services.

Municipal Exemption from the County Library Tax

Municipalities that operate public libraries established under Chapter 43 of the Wisconsin Statutes assess a property tax levy so that they may appropriate funds for their public libraries. The amount of this appropriation is based on both the needs of the public library as a municipal department and the budget priorities of the municipality as a whole.

Under Wis. Stat. sec. 43.64(2)(b), a municipality that operates a public library may request an exemption from the county library tax levied under s. 70.62(1) if it appropriates an amount to its library above a defined minimum. The exemption would then exclude that municipality's properties from the county tax levy that funds library services provided to individuals who live within the county but outside of those municipalities in the county that operate public libraries.

Exemption from the county library tax must be calculated and requested by the municipality, in writing, each year. However, public library administration should be aware of the process, as this calculation may have an impact on the library's budget proposal process. Because the calculation relies upon equalized property values, the calculation may be made on or after August 15 of each year, when the Wisconsin Department of Revenue releases the current year's county apportionment report.

Nearly all public libraries are funded by their municipalities at levels well above the minimum amount required for exemption from the county library tax, but several municipalities use this amount as a baseline for budgetary support to their public libraries. These municipalities should be aware that factors such as countywide changes in the equalized value for each municipality in the county, increases or decreases in the county library levy, changes in municipal library appropriations, and changing exemption status of other municipalities within the county may cause the minimum exemption amount to fluctuate significantly.

Public library directors with questions about the calculation and budgetary implications should contact their regional public library systems. Municipalities and counties with procedural questions or concerns about how the calculation impacts local accounting and taxes should contact their auditors, financial advisors, or peers.

Other Financial Considerations

Sales Tax and Public Libraries

Wisconsin public libraries may be subject to sales tax. Questions about sales tax laws and regulations should be directed to the Wisconsin Department of Revenue at (608) 266-2776.