Introduction

The development of a school district’s budget is a long-range process that typically consists of seven distinct steps. Associated individuals must be vigilant as new information coming to the school district often impacts the district’s overall budget and local levy amounts. Select an appropriate step link below for further details.

- Step #1 - Development of a Proposed Budget

- Step #2 - Budget Hearing Requirements

- Step #3 - Annual Meeting Requirements

- Step #4 - Original Budget Adoption Procedure

- Step #5 - Setting of the Levy and a Sufficient Tax Amount Requirements

- Step #6 - Guidance for Completing the PI-401

- Step #7 - Budget Changes/Amendments Process

- Resources including blank and prepopulated PI-65.90 workbooks

Step #1 - Development of a Proposed Budget

The staff and school board should collaborate to develop a proposed budget that identifies expected revenues, expenditures and fund balances for the budgeted year. Such a budget should also show actual revenues and expenditures for the preceding year, actual revenues and expenditures for not less than the first six months of the current year and estimated revenues and expenditures for the balance of the current year. Such a budget should also show for informational purposes by fund all anticipated unexpended or unappropriated balances as well as surpluses per Wis. Stat § 65.90.

Staff, Administrator and School Board Collaboration

The collaboration between all staff, administrators and the school board will allow for better understanding and agreement of the final school board approved budget. The budgeting detail is based upon the Wisconsin Uniform Financial Reporting Requirements (WUFAR) hierarchy of accounts. Prior to the budget hearing, the school board must approve a proposed budget to present at the budget hearing.

Additional Notes

- Authority between July 1 and final adoption of a budget.

- Per Wis Stat § 120.13(33) during the period between July 1 and the final adoption of a budget by the school board after the budget hearing under Wis Stat § 65.90, spend money as needed to meet the immediate expenses of operating and maintaining the public instruction within the school district.

- Temporary borrowing by school boards is specifically authorized by Wis Stat § 67.12(8).

Step #2 - Budget Hearing Requirements

The procedures which common, union high and unified school districts should follow to formulate a budget, hold a public hearing and adopt a budget can be found in Wis Stat § 115.01(3) and Wis Stat § 65.90.

Frequency of Hearings

All districts are required to hold a budget hearing. Wis Stat § 120.08 requires every common and union high school district to hold an annual meeting. Common and Union High School (UHS) school districts are required to hold the budget hearing at the same time and place as the annual meeting per Wis Stat § 120.08.

Per Wis Stat § 65.90(4), "not less than 15 days, and in the case of common school districts, not less than 10 days, after the publication of the proposed budget and the notice of hearing thereon a public hearing shall be held at the time and place stipulated at which any resident or taxpayer of the governmental unit shall have an opportunity to be heard on the proposed budget. The budget hearing may be adjourned from time to time. In school districts holding an annual meeting, the time and place of the budget hearing shall be the time and place of the annual meeting."

Class 1 Notice

A class 1 notice (one publication) under Wis Stat § 985.07 shall contain a summary of the proposed budget that is described in step #1 above, along with notice of where the detailed budget may be examined and notice of the time and place of the public hearing. The following procedures are for publishing notice of the budget hearing and the proposed budget summary:

- Common School District – at least 10 days prior to the hearing per Wis Stat § 65.90(3)(a)3

- Unified and UHS Districts – at least 15 days prior to the hearing per Wis Stat § 65.90(3)(a)

Step #3 - Annual Meeting Requirements

Following the budget hearing, the electors at the annual meeting of common and union high school districts have the power to vote a tax for the purposes set forth in Wis Stat § 120.10.6. The school board of a unified school district has the power to vote the tax.

Meeting Date and Time Specifics

Common school districts shall hold an annual meeting on the fourth Monday in July at 8 p.m., while union high school districts shall hold an annual meeting on the third Monday in July at 8 p.m. unless the electors at one annual meeting determine to thereafter hold the annual meeting on a different date or hour, or authorize the school board to establish a different date or hour. No annual meeting may be held before May 15 or after October 31 per Wis Stat § 120.08(1)(a).

Class 2 Notice

School districts must publish a class 2 notice, under Wis Stat § 120.08 and Wis Stat § 985.07, of the time and place of the annual meeting, the last insertion to be not more than eight days nor less than one day before the annual meeting. Note: A class 2 notice requires a minimum of two insertions, one each week for consecutive weeks. Wis Stat § 985.02(2) and Wis Stat § 985.02(3) provide direction to school boards who elect to post the budget summary in at least three public places and/or the Internet for citizens to view.

Format and Template

DPI School Financial Services (SFS) team encourages school districts to use the following format for the publication requirement:

Wis Stat § 65.90(3)(c) DPI under Wis Stat § 115.28, the Department of Revenue under Wis Stat § 73.10 and the Technical College System Board under Wis Stat § 38.04 shall encourage and consult with interested public and private organizations regarding the budget summary information required under pars. (a) and (b). DPI and the Technical College System Board shall specify the revenue and expenditure detail that is required under par. (b) 1. and 2. for school districts and for technical college districts."

The template is located in the DPI Budget Hearing and Publication Workbook.

Energy Efficiency Exemption Projects

School districts who have Energy Efficiency Exemption projects must meet the following statutory requirements.

Revenue Limit Exemption for Energy Efficiency Projects - Wis Stat § 121.91(4)(o)1

New Law as a result of Act 59 - Energy Efficiency Exemption (EEE) to the Revenue Limit:

Per 2017 Wisconsin Act 59 (2017-19 Budget), school boards are prohibited from adopting a resolution to utilize the Energy Efficiency Exemption to the revenue limit after December 31, 2017, through December 3018. School Boards have the authority to adopt EEE resolutions after October 1, 2017 and before January 1, 2018 that are applicable beginning in 2018-19 and thereafter. A school board may issue debt after December 31, 2017, to fund the energy efficiency exemption project(s) that were approved by the school board prior to December 31, 2017.

Under current law, resolutions may not be passed after December 31, 2017. This includes changes to any existing resolutions. Districts considering one year operating exemptions in 2018-19 and beyond should consider the potential consequences of the inability to change the resolution after December 31, 2017. DPI SFS is seeking further interpretation of the law related to resolutions for refinancing debt and will share any new information and/or interpretation when available.

School boards who have approved energy efficiency resolution(s) prior to December 31, 2017 are required to publish an evaluation of the identified energy performance indicators as an addendum to the published budget summary document under Wis Stat § 65.90 and in the school’s newsletter or in the published minutes to the school board meeting.

For additional information please refer to the Revenue Limits Exemptions - Overview and Administrative Code Chapter PI-15.

Post-Employment Benefits Reporting

If a school board has established a trust described in Wis Stat § 66.0603(1m)(b)3 for post-employment benefits, the annual meeting report shall state the amount in the trust, the investment return earned by the trust since the last annual meeting, the total of disbursements made from the trust since the last annual meeting, and the name of the investment manager if investment authority has been delegated under Wis Stat § 66.0603(3)(b).

Step #4 - Original Budget Adoption Procedure

The school board shall adopt an original budget at a school board meeting scheduled after the public hearing and no later than the meeting in which the school district sets the amount of the tax levy under Wis Stat § 120.12. The adopted school board approved annual school district budget is commonly referred to as the legally adopted original budget.

Step #5 - Setting of the Levy and a Sufficient Tax Amount Requirements

Wis Stat § 120.12(3)(a) and (c) require that on or before November 1, a school board must determine if the tax voted at the annual meeting is sufficient to operate and maintain the schools for the school year. If the amount so determined is not sufficient, the school board shall raise the tax, while the board may lower the tax if the amount so determined exceeds requirements. The tax levy shall not exceed limits established by Wis Stat § 121.91.

The taxes levied must be certified to municipalities on or before November 10:

- The school board clerk must set the levy and adopt an original budget on or before November 1

- The school board clerk must certify the levy to the municipalities on or before November 10

Step #6 - Guidance for Completing the PI-401

The district should not enter data into this application unless their revenue limit computation has been updated with their third Friday FTE student enrollment, October 1 Tax Apportionment values and their Aid Certification amounts (thus completing all the information required to ensure the district levies within their revenue limit). Additionally, the school board must have officially voted on levy amounts for that year. These instructions may also be viewed in the SFS Budget and Adoption Process Overview page (step #6) for specific instructions on completing the PI-401.

Instructions for Completing the PI-401

Accessing the PI-401 Tax Levies Report

The PI-401 Tax Levies Report can be accessed through the WiSFip. District personnel can go to the "Status and Deadlines" link or the "Financial Data Home" link and select the PI-401 Tax Levies Report. You must enter your user id and password to log into the program. Instructions for Completing the PI-401 are also available.

The district should not enter data into this application unless their revenue limit computation has been updated with their third Friday FTE student enrollment, October 1 Tax Apportionment values and their Aid Certification amounts (thus completing all the information required to ensure the district levies within their revenue limit). Additionally, the school board must have officially voted on levy amounts for that year.

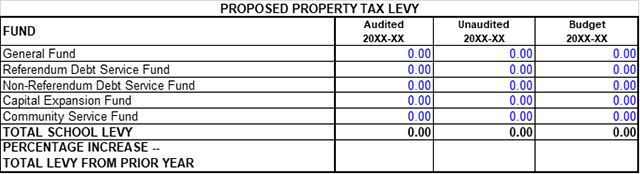

Tax Levy Input by Fund

After logging into WiSFiP, the district is to complete the contact information page. Once that is completed, the district is to enter the tax levy by fund. Districts are reminded to review the data thoroughly. The total levy amount entered should agree with--and equal--the amounts for the Fund 10 levy, Fund 38 non-referendum debt, Fund 41 capital expansion, Fund 39 referendum-approved debt, Fund 80 community service and prior-year levy chargeback of the district’s revenue limit worksheet.

Reasonability Report

The next step is to view a reasonability report that compares the current year levy with the prior year levy. If the reasonability report is correct, go to the next webpage.

Submitting the PI-401 to DPI along with Printing the Certification Page and PI-1508 Forms

While submitting the PI-401 to DPI, the user may have to click on "Review Your Answers" which will take the user to the FY 20XX-20XX Tax Levy summary. Please review this data for accuracy. Once in that page, select the PI-1508 forms link, found in the Helpful Links section. After these forms are downloaded, print the PI-1508 and then the PI-401 tax levy certification page. The district is required to sign the forms and maintain these forms in the district records. The School District's Clerk, along with a Notary Public must sign these forms. Once signed, the forms must send these completed forms to their municipalities.

Note that the levy by municipality has already been calculated. This information will be electronically submitted by DPI to DOR on the district's behalf. There is no longer a paper form that is submitted to DOR.

On behalf of the school district, DPI will transmit to DOR the reported levy amounts. Districts may return and amend their data after the original submission. However, after the second Monday in November, districts will first need to contact a School Finance Consultant to open the PI-401 program.

Step #7 - Budget Changes/Amendments Process

The annual original budget provides the best estimates at the time of adoption of the resources and costs of the activities of the school district for the ensuing months of the school year. As the year progresses, there may be a need to change appropriations and purposes. Because such changes range from minor changes to significant ones, a question does arise concerning when the two-thirds vote and publication are required.

When the Vote and Publication are Required

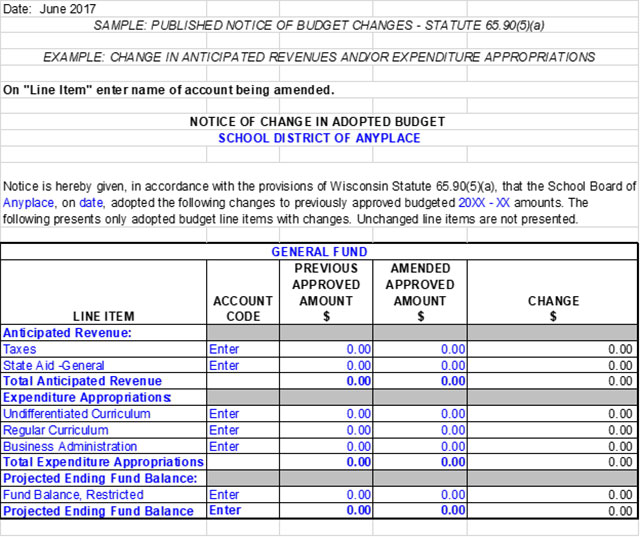

Pursuant to input from the Wisconsin Association of School Boards, school district officials and legal counsel, DPI recommends that the two-thirds vote, per Wis Stat § 65.90(5)(ar), along with the required publication notices, be required if the amount of appropriation and the purposes (functions) as presented in the line items of the adopted budget are changed. Changes in subordinate line items from which the adopted budget evolved (but which are not detailed in the adopted budget) do not require the two-thirds vote and publication. School district treasurers must also comply with Wis Stat § 120.16(2) to assure disbursements from the school district treasury are made within the law. In addition, a class one notice must be published or post a notice of the changes on the district's website within 15 days after any change to a school district's budget is made per Wis Stat § 65.90(5)(ar) and Wis Stat § 985.02.

Budget Hearing and Adoption Workbook Sample

The following sample is provided to assist school districts with their budget changes/amendments procedures. This sample can be found in the Budget Hearing and Adoption Workbook.

Resources and More Information

- PI-65.90 blank and executable workbooks for Budget Adoption (Wis Stat § 65.90)

- Budget Report Workbooks

- Debt Amortization Schedule Instructions

- Estimating Equalization Aid, Revenue Limits and Categorical Aids

- General Aid Worksheets (current and historical)

- Revenue Limit Worksheets

- SAFR Budget Report Teaching Tutorials