Background

The Every Student Succeeds Act (ESSA), signed into law in December 2015, added to federal law the requirement for School Level Reporting (SLR). However, with the subsequent change in federal administrations, there is currently (as of October 1, 2018) no formal guidance from the U.S. Department of Education on how to implement it. In response, the Council of Chief State School Officers, working with the Georgetown University Edunomics Lab, convened the Financial Transparency Working Group (FitWig) to discuss and provide recommendations on some of the more detailed questions prompted by SLR.

Format Overview

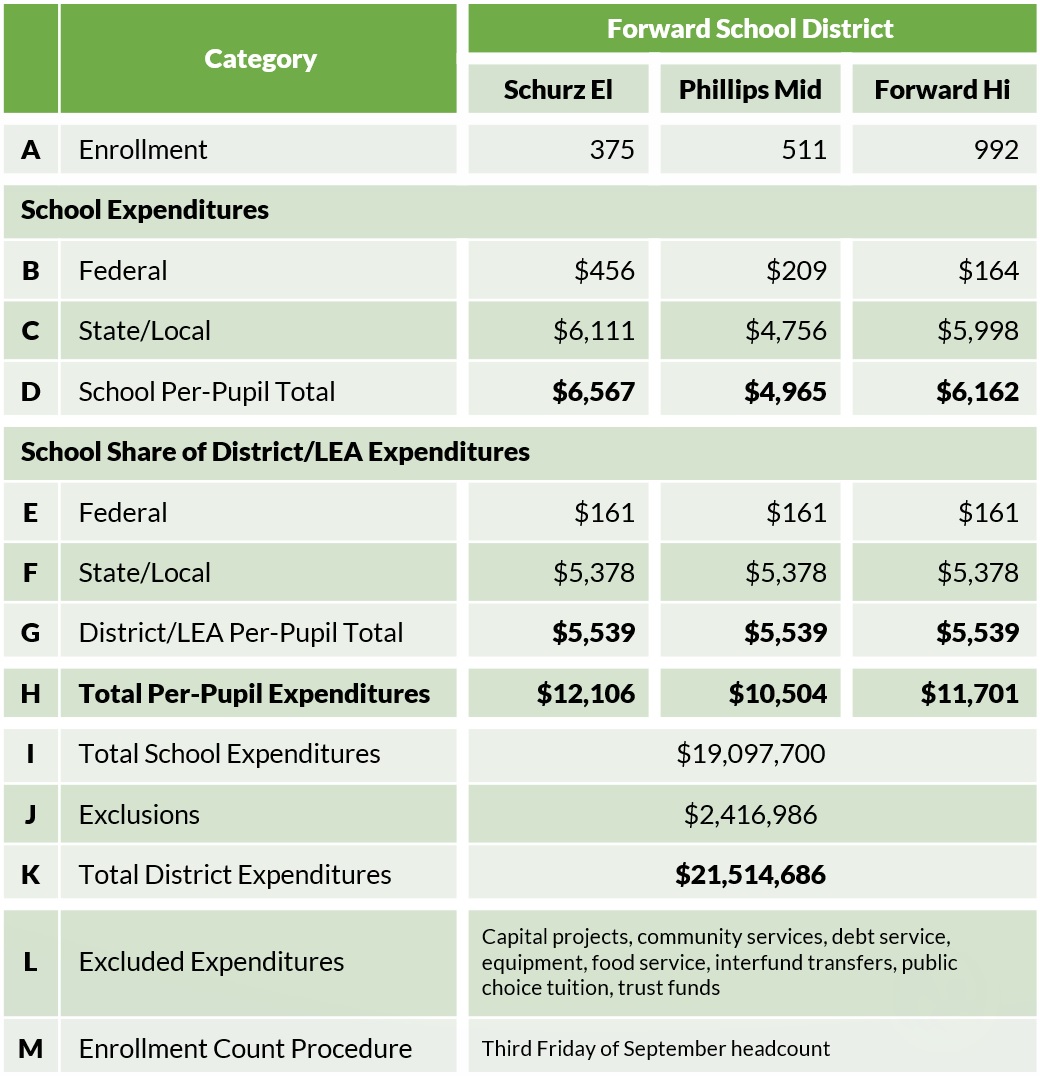

The School Financial Services (SFS) team has developed its SLR collection and reporting tools around a common Interstate Financial Reporting format developed and recommended by FitWig in December 2017. It is designed to meet the SLR requirement of ESSA as consistently as possible, given the differences in accounting systems, practices and data reporting capacities across states, with specific attention to costs that do not necessarily reflect the operational costs of educating students year to year. This format can be summarized in one chart:

Each item is labeled with a letter A through M and has a specific definition.

Format Definitions

A: Enrollment

For a school, this item is the non-weighted enrollment of students served in that school. "Non-weighted" means that every student is counted as one regardless of their age or grade. In Wisconsin, we use a weighted number for funding purposes with students in 4-year-old kindergarten and preschool special education. When and how students are counted is shown in item M.

B-D: School Expenditures

These items show the per-pupil (amount per student) expenditures assigned or allocated to a school. Item B is the portion of those expenditures paid with federal funds, while item C is the portion paid with state and local funds (such as property taxes, state aids, student fees or other non-federal sources). Item D is the sum of B and C.

E-G: School Share of District/LEA Expenditures

These items show the per-pupil expenditures assigned or allocated to the district/LEA as a whole, rather than to the individual schools being reported. The per-pupil number is the same for every school. As with the school-level expenditures, item E is the portion paid with federal funds, item F is the state and local portion and item G is the sum of E and F. The FitWig format does not include a specific definition of the difference between school and district/LEA levels.

H: Total Per-Pupil Expenditures

This item is the sum of items D and G. We expect this will be the focus of attention for members of the public, media and policymakers throughout the U.S. in discussions about fairness, equity and return on investment.

I: Total School Expenditures

This item is the total amount of all the expenditures included in per-pupil reporting at the school or district/LEA levels. It is approximately the same as multiplying item A by item H for every school and then adding all the results, but it will not be exactly the same due to per-pupil numbers being rounded to the nearest dollar.

J: Exclusions

This item is the total of all the expenditures listed in item L, which are excluded from per-pupil reporting.

K: Total District Expenditures

This item is the sum of items I and J. It represents the grand total of expenditures for all of a district's/LEA's activities. For a Wisconsin school district, it is the amount that a member of the public would get by adding together all the individual fund totals in the district's s. 65.90 format adopted budget.

L: Excluded Expenditures

This item lists the categories of expenditures excluded from per-pupil reporting in each school’s item H. Exclusions are discussed further in the next section.

M: Enrollment Count Procedure

This item shows the procedure used by the state or LEA to count students for the enrollment number in item A. In Wisconsin, we are using the third Friday of September headcount, which is the basis of most other Department of Public Instruction (DPI) reporting, including the School and District Report Cards.

Exclusions

One of the first questions addressed by FitWig was about how to report expenditures outside of an LEA’s annual decision on how to allocate resources for its schoolchildren in the school year, such as with building projects, capital equipment or community and recreational programs. The solution FitWig identified was to create an "exclusions" category, where spending on these items could be reported to the public without introducing an extra level of variability in per-pupil comparisons across schools, LEAs and states. Exclusions are not used in reporting and calculating a per-pupil total for each school.

SFS and the Wisconsin Association of School Business Officials (WASBO) workgroup identified a list of "Recommended Standard Exclusions" that we suggest be used by all Wisconsin LEAs to enable, as much as possible, apples-to-apples comparisons while honoring the intent of the law. These exclusions currently include the following:

- Aid Transits: Payments of aid revenues belonging to other educational agencies. WUFAR: Funds 10, 21, 27, 29; function 491000.

When a district/LEA contracts for services with another educational agency, the other agency may receive state or federal aid funding for those services as the employer or service provider. In these cases, the agency receiving the aid owes it back to the district/LEA who ultimately paid for the services. - Capital Projects. WUFAR: all 40 funds.

A district will often borrow money or use special segregated funds to pay for construction, renovation, land acquisition or other major capital projects. In these cases, actual project costs are accounted for in a separate fund, and state aid is either paid on the district's debt costs or based upon how money was set aside in previous years. - Certain Non-Accountability Students: Costs of educating certain students outside the statewide accountability system. WUFAR: varies.

In certain situations, a district/LEA may have some actual, additional costs for educating a student outside the statewide accountability system used for School and District Report Cards. These include:- adult students completing an HSED program;

- services to homeless youth not enrolled as students but required under the federal McKinney-Vento Act;

- home-based private students taking one or two classes part-time under s. 118.53, Wis. Stats.;

- resident students attending a multi-district virtual charter school operated by another school district; and

- out-of-state residents enrolled for the purpose of receiving special education and related services under their IEP.

- Community Services: Community programs and services. WUFAR: Fund 80.

Districts may offer community and recreational programming outside of its usual educational program for school-age children. - Cooperative Programs: Non-district share of cooperative programs. WUFAR: For a Fund 99 cooperative program, total 99E minus 99R 411000 110; for a Funds 10/27 cooperative program, the total costs minus 10/27R 300 from the other districts for their shares of the program.

Districts may enter into a cooperative agreement under s. 66.0301, Wis. Stats. to provide a program or service. One district serves as fiscal agent for the cooperative and employs any staff. For the fiscal agent, only its own costs should be included in SLR--the other districts' shares are excluded. - Custodial Funds: Non-trust funds meeting the definition of "custodial" under GASB 84. WUFAR: Fund 60

A district/LEA may hold funds on behalf of a parent, student, or other school-related group. In order to identify a group's funds as custodial, the district/LEA must not be exercising "administrative involvement" over the use of those funds. If the district/LEA is exercising administrative involvement, then the funds must be classified as controlled by the district/LEA and coded as such (usually to the General Fund [Fund 10] or Special Revenue Fund [Fund 21]). - Debt Service: Costs of long-term debt and capital leases. WUFAR: All 30 funds; 10E 281000 678/688.

Principal and interest payments on long-term debt issued for major projects or capital leases. - Equipment: Equipment and other capital objects. WUFAR: Funds 10, 21, 27, 29; all functions but 255000; all 500 objects.

As with capital projects, a district/LEA will purchase vehicles, boilers and other major pieces of equipment and machinery. These have a significant cost and are expected to last for many years. - Facilities: Facilities acquisition and remodeling. WUFAR: Funds 10, 21, 27, 29; function 255000.

A district/LEA may choose to pay for remodeling, land acquisition, construction& or facility rental out of its operating funds. - Food Service: School and elderly nutrition programs. WUFAR: Fund 50.

School lunch, breakfast and other food service programs are operated in a separate fund and under separate requirements from a district's/LEA's other activities. - Independent Charter Tuition: Independent non-district charter school tuition payments. WUFAR: 10E 439000 387.

New authorizers of independent charter schools were created in the 2015-17 state budget. Payments for students in these schools are funded by state aid deductions from their resident districts. - Interfund Transfers: Accounting transfers to other funds. WUFAR: Funds 10, 21, 27, 29; functions 411000, 418000, 419000.

The accounting system prescribed by DPI for Wisconsin school districts uses "interfund transfers" to move money between funds in certain situations in order to balance a district's books as a whole. These are accounting artifacts, not actual costs. - Private Choice Tuition: Private school WPCP/RPCP and SNSP voucher payments. WUFAR: 10E 438000 387.

The amount of state aid withheld from a district for its resident students attending private schools under one of the Parental Choice (or "voucher") Programs which is recorded as an expenditure for accounting purposes. - Public Choice Tuition: Public school Open Enrollment payments. WUFAR: 10E 435000 382.

The amount of state aid withheld from a district for its resident students attending another district under Open Enrollment which is recorded as an expenditure for accounting purposes. - TEACH Fund: TEACH debt or equipment. WUFAR: Fund 23.

A small number of districts still have funds left over from the TEACH technology expansion program several years ago which can be used for equipment or debt payments under the program. - Trust Funds: Private purpose trust funds. WUFAR: All 70 funds.

A district/LEA may hold funds used to endow scholarship programs for its graduates or to pay in advance for certain types of retiree benefits. These funds do not belong to the district/LEA but rather are held in trust.

An LEA may decline to use a Recommended Standard Exclusion if they believe it appropriate to include those expenditures in its per-pupil amounts or if the exclusion does not apply to the LEA (for example, an LEA with no debt may wish to omit the exclusions for debt service). An LEA may also report additional, optional exclusions if it believes there are additional expenditure categories that do not reflect "actual personnel and non-personnel expenditures" in any of its schools.